Are you tired of seeing your hard-earned money grow at a snail’s pace in your bank’s fixed deposit (FD)?

Of course, and we all are!

Now, if you’re searching online for “Which BANK FD Offers Better Returns in 2025 in Delhi?”, you’re not alone. While the existing rates of interest offered by conventional banks seem to offer somewhere around 7%, the same is not sufficient considering the rising cost of living. On top of that, the average inflation rate of around 6% nearly flattens the graph of your financial growth, leaving you with what you can rarely call ‘profit.’

That’s why the ‘snail’ analogy.

But what if I told you, that there is, indeed, a way to get much better returns than what traditional banks offer, right here in Delhi?

Hard to believe? Don’t worry!

In this blog, I will be taking you through an eye-opening journey on how you might have been saving wrong up until now. You will also learn how you can put your hard-earned money to work harder for you, earning you substantial profit as interest income.

Let’s dive into the world of fixed deposits and discover an option that’s turning heads in 2025.

The Usual FD Scene: What Most Banks Offer

Let’s start with what you probably already know. Most major banks in Delhi—whether public or private—offer FD Interest Rates in Delhi that usually hover between 6% and 7.5% per annum for regular customers. Senior citizens might receive slightly higher returns, but even then, the rates rarely cross 8%.

As of August 2025, the highest one-year fixed deposit (FD) rates in India still hover under double digits. For private banks, Bandhan Bank leads with up to 8.55 % p.a. for senior citizens and 8.05 % for general customers on one-year FDs (source), and RBL Bank offers attractive digital FD rates (source). On the public sector side, the Central Bank of India tops the chart with around 7.40 % p.a. for senior citizens (e.g., on special 444-day or 555-day deposits) and 6.70 % for general users (source).

- Public Sector Banks: 6% to 7.4% per annum (up to 7.4% for senior citizens)

- Private Banks: 6.5% to 8.55% per annum (up to 8.55% for senior citizens)

- Senior Citizen Rates: Usually 0.5% to 1% higher than regular rates

While these rates may appear competitive, they often struggle to outpace rising inflation—especially for non-senior investors. The plateaued returns seldom make a significant dent in financial growth goals.

The Inflation Dilemma: Are Your Savings Really Growing?

Let’s pause and think: If inflation is running at 6% and your FD is giving you 7%, your real gain is just 1%. That’s not much, is it?

Over time, inflation quietly eats away at your purchasing power. So, the question isn’t just “Which BANK FD Offers Better Returns in 2025 in Delhi?”—it’s also “Which FD actually helps me beat inflation and save for my goals?”

“The real value of your savings depends not just on the interest rate, but on how much it outpaces inflation.”

Samridh Bharat Cooperative T&C Society – A Companion to Put You On the Right Track of Real Financial Growth

Now that you know, you can do better than a mere 7% yearly interest, the next question should be – ‘where?’

The answer – Samridh Bharat Cooperative Thrift & Credit Society, Delhi.

Why?

Here’s the answer:

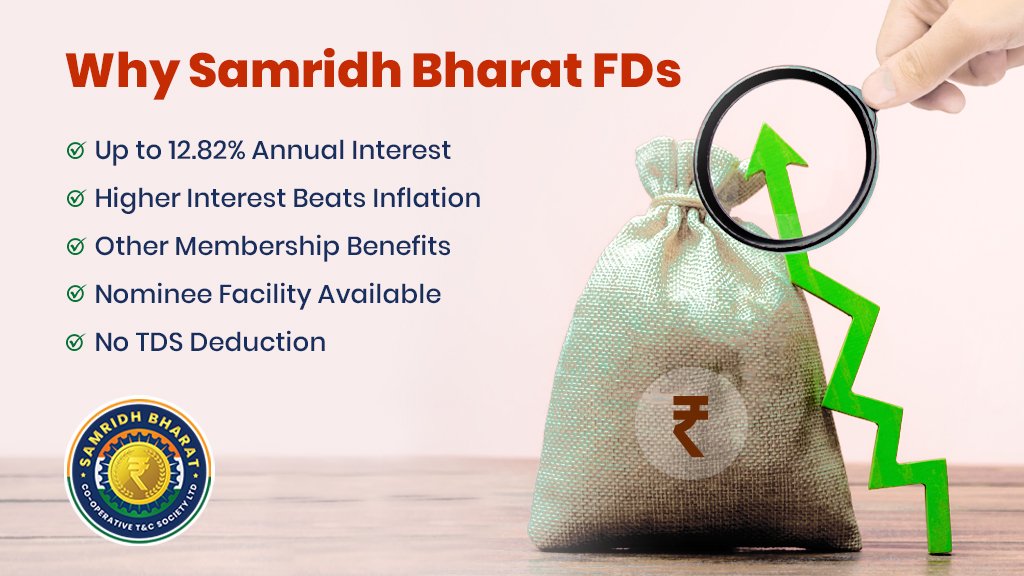

At Samridh Bharat Cooperative Society, we offer you a minimum of 10.5 % and up to 12.82 % annual interest, regardless of age. It’s a compelling and comparatively a far better and profitable option – especially when you are locking in your amount for an extended period of time.

With our head office in Vasant Kunj, Delhi, the name ‘Samridh Bharat’ is making waves all over Delhi. Within a span of just around one and a half years, we are now among the fastest growing family of more than 2700 members.

What Makes Samridh Bharat Stand Out?

- Higher Interest Rates: 10.5% to 12.82% per annum is a game-changer, especially when compared to regular banks.

- Beats Inflation: With these rates, your money isn’t just safe—it’s actually growing in real terms.

- Membership Benefits: As a member, you get access to other financial products, community support, and exclusive offers.

- Attractive Joining Gifts: Who doesn’t love a good welcome? New members receive useful and attractive gifts when they join.

- Personalized Service: Being a cooperative, the focus is on members’ welfare, not just profits.

How Does It Work? Understanding Cooperative Societies

You might be wondering, “Is this too good to be true?” Let’s clear the air. Cooperative thrift and credit societies like Samridh Bharat are regulated entities, registered under the Multi-State Cooperative Societies Act. They operate on the principle of mutual benefit—members pool their resources, and the society uses these funds to offer loans and FDs at competitive rates.

Key Features of Samridh Bharat Cooperative FDs

- Flexible Tenure: Choose the deposit period that suits your needs.

- Safe and Transparent: Regular audits and member-driven management.

- Easy Process: Simple documentation and quick account opening.

- Community Focus: Profits are shared among members, not outside shareholders.

Comparing Returns: Traditional Banks vs. Samridh Bharat Cooperative

Let’s put the numbers side by side. Suppose you invest ₹1,00,000 for 3 years.

Institution Interest Rate (p.a.) Maturity Amount (3 years)

- Public/Private Bank (7%) – ₹1,22,504

- Public Sector Highest (7.4%) – ₹1,24,002

- Private Bank Highest (8.55%) – ₹1,28,985

- Samridh Bharat Cooperative (12.25%) – ₹1,46,367

That’s a difference of over ₹17,000 between the best private bank and Samridh Bharat’s highest rate!

More Than Just Returns: Other Membership Benefits

When you join Samridh Bharat Cooperative Thrift & Credit Society, you’re not just opening an FD. You’re becoming part of a community. Here’s what else you get:

- Access to Loans: Need a personal or business loan? Members get priority and better rates.

- Financial Planning Support: Get advice on how to save and invest smarter.

- Exclusive Events: Participate in member-only workshops, seminars, and social gatherings.

- Diwali Gift: We regard all our members with attractive and utilitarian gifts every year on the auspicious occasion of Diwali.

You also get a premium quality diary and calendar every new year.

Is It Right for You? Things to Consider

While the higher returns are tempting, it’s important to do your homework:

- Check the Society’s Credentials: Make sure it’s registered and has a good track record.

- Understand the Terms: Read the FD terms and conditions carefully.

- Diversify: Don’t put all your eggs in one basket. It’s wise to spread your investments.

How to Get Started

If you’re interested in exploring this option, here’s what you can do:

- Visit the Our Office: Drop by the Samridh Bharat Cooperative Thrift & Credit Society in Vasant Kunj, Delhi.

- Ask Questions: Talk to their staff, understand the process, and clarify any doubts.

- Become a Member: Fill out the membership form and submit the required documents.

- Open Your FD: Choose your deposit amount and tenure, and start earning higher returns.

Wrapping Up: Make Your Money Work Smarter in 2025

So, if you’re still searching for “Which BANK FD Offers Better Returns in 2025 in Delhi?”, it’s time to look beyond the usual suspects. The Samridh Bharat Cooperative Thrift & Credit Society is offering FD rates of 10.5% to 12.82%, which not only beat traditional banks but also help you stay ahead of inflation and save for your goals. Plus, with extra membership benefits and attractive joining gifts, it’s a win-win.

“Don’t let your savings sit idle. Explore smarter options and let your money grow faster in 2025!”

Ready to take the next step? Visit our head office or the Rohini or Mandawali branch today. Alternatively, you can call or WhatsApp us at 9667837771 to get started!

Disclaimer: Samridh Bharat Cooperative Thrift & Credit Society Ltd. is an Urban Thrift and Credit Cooperative Society registered under the DCS Act, 2003 (Reg. No. 10844) based in Delhi. We are not a bank. To avail any service, membership is mandatory. All deposits are subject to society terms, and interest rates may be revised from time to time by the society’s core committee. Being a registered cooperative society (not a bank), DICGC deposit insurance does not apply to us.