In view of today’s financial landscape, finding the right savings account is a big challenge. Dumping your hard-earned cash in a financially incompetent savings account can negatively impact your wealth-generation ability. As growing your money depends primarily on the interest earned, finding the right savings account is crucial.

The answer to the question of whether there is a type of savings account with the highest interest rates is ‘Yes.’ There is a specific type of savings account with the highest interest rate, even more than traditional financial institutions. At Samridh Bharat Co-operative Thrift & Credit Society Ltd., we offer just the savings account with the highest interest rates, more than the regular financial institutions.

If you’re exploring Delhi cooperative society savings interest rates, our offering stands out for financial prosperity with unmatched returns. Luckily, this account offers more than just one benefit, such as earning you better interest rates.

Trust of the Office of the Registrar – Co-operative Thrift & Credit Society, New Delhi

Samridh Bharat Co-operative Society is registered under the Delhi Co-operative Societies (DCS) Act 2003, with registration number 10844. Our society works in full compliance with the guidelines, rules, and bylaws enforced by the Office of the Registrar Co-operative Societies J6G7+5CJ, Sansad Marg, Old Court Building, Janpath, New Delhi, Delhi 110001.

The office periodically and regularly assesses the functioning of the society and is fully authorized by the government to mediate whenever required.

Decisions are Taken Collectively

Samridh Bharat Society works on the foundational principle of ‘co-operation’. Every single member contributes to the work and growth of the society. The basic requirement to become a member of our society also requires you to have at least 4 shares of the society, empowering you and every other member equally.

When you’re looking for reliable and profitable high-interest savings in the Co-operative Society of Delhi, being part of Samridh Bharat offers both transparency and value.

Regular General Meetings

The society regularly holds General Meetings, as per the bye-laws in force. In general meetings, policies, interest rates, roles and responsibilities of the staff, special provisions, and additions and omissions from the existing provisions are discussed and brought into effect.

Child Welfare, Women Empowerment & Helping the Youth

At Samridh Bharat Co-operative Thrift & Credit Society Ltd., social welfare remains at the top of our long-term goals. With our efforts and mutual financial goals, we aim to help underprivileged children with their regular and higher studies.

Moreover, we work towards empowering women by providing them with the necessary training and employment. We also work towards empowering youth and society’s members, helping them gain the required knowledge and skills for employment.

Choosing us means choosing an institution that not only offers some of the best Delhi cooperative society savings interest rates, but also uplifts the society around you.

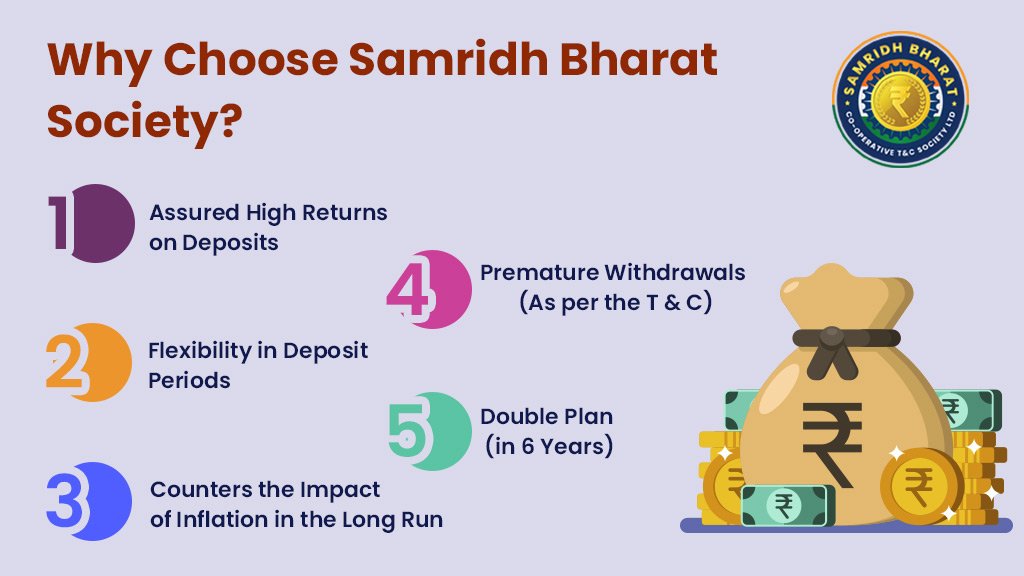

Key Reasons to Join Samridh Bharat Society

- Prime Location: Head Office in the prime location of Delhi at Vasant Kunj.

- Accessibility: Easy to avail loans for different small and big needs.

- Tax Efficiency: No TDS on interest earned.

- High Returns: Ideal interest rates on deposits compared to all banks.

- Stability: Fixed interest rates and, therefore, no risk of volatility like in the securities market.

- Expert Leadership: Highly educated, experienced, and capable core members’ team.

- Inclusive Growth: Members from all walks of life and all income groups cooperate for the collective growth of this society harmoniously.

- Safety: Expert legal & advisors to make sure of financial security and a safe ecosystem in society.

- Advanced Technology: Backed by advanced and some of the best technologies.

- Digital Services: Digital cash management, internet banking, debit/credit card, QR, and UPI-based payments.

- Data Protection: Assured data security through fully digitalized operations as well as physical files and digital backup utilizing 256-bit encrypted SSL.

Our Savings Account with the Highest Interest Rate

We understand the importance of savings and the impact of the inflation rate on your savings. Our Savings Deposit is a type of Optional Deposit (OD) wherein you can deposit any amount one time or as and when you have some cash lying idle.

Your OD account provides you with a 7% annual interest rate on your savings, the best in the segment. This makes our OD account a savings account with the highest interest rate, better than that of private and public sector banks. Among the top Delhi cooperative society savings account interest rates, this is a clear winner for anyone serious about growing their money.

By depositing in your OD account, you are safeguarding your money from the effects of inflation, which diminishes your purchasing power each year. Take advantage of this savings account with the highest interest rate of 7% per annum and win the financial race.

How to Invest in India’s Best Savings Account?

- Call or WhatsApp us, or visit our office or a branch to request your membership form.

- Bring your documents, such as Voter ID Card, Pan Card, Passport-Sized Photos, and Address Proof.

- Fill out the membership form and deposit your membership charges.

- Fill out your Option Deposit/Savings Deposit form and deposit the minimum amount to start with.

- Receive your welcome kit, your passbook, and any other important documents.

- A text message on your registered phone number confirms the activation of your savings deposit.

To learn more or to join Samridh Bharat, call us at 9667837771. Alternatively, you can also send a message on WhatsApp at 9667847771.

Frequently Asked Questions

Q1. What’s the savings interest rate at Samridh Bharat as compared to traditional financial institutions?

Ans: Samridh Bharat provides 7% of interest rate on a regular savings account, which is higher than any other regular savings deposits provide.

Q2. Is membership required to open an account?

Ans: Yes. Membership is mandatory to open a savings account with Samridh Bharat and avail any of our deposit services.

Q3. What is the minimum documentation needed to start?

Ans: You only need to bring documents, such as a government-issued ID, PAN Card, two recent passport-sized photographs, and address proof.

Q4. Is there a tax deduction (TDS) on the interest earned?

Ans: One of the biggest perks of joining Samridh Bharat is that you get to enjoy the tax-free earnings from the interest earned.

Q5. How safe is Samridh Bharat?

Ans: We are registered under the Delhi Cooperative Societies Act, 2003, with registration number 10844. This ensures the regulation and transparency of our actions, along with accountability.

Q6. Can I withdraw my money from the savings deposit whenever I want?

Ans: Absolutely. Samridh Bharat offers the flexibility of premature withdrawal of any investment along with the applicable interest rate.

Q7. Are there any investment options specifically for children?

Ans: Yes. Long-term schemes like Swarnim Bhavishya are provided especially to secure the future of the children.

Q8. What other types of deposits are available besides a savings account?

Ans: We provide investment plans, such as Fixed Deposits (FDs), Recurring Deposits (RDs), and Monthly Income Schemes (MIS), along with Savings accounts.

Pingback: A Comprehensive Guide to the Savings Accounts with Highest Interest Rates – Samridh Bharat Society

Pingback: Finding the Savings Account with the Highest Interest Rate – Samridh Bharat Society

Pingback: Which is the Most Trusted Bank for Higher Interest Savings Account? – Samridh Bharat Society

Pingback: Unlock the Power of a Savings Account with Highest Interest Rate for Future – Samridh Bharat Society